Daily shippers (or shippers with set days per week, i.e. Tue & Thu for example) will have an agreed daily collection window, as set up by RDS Global Solutions with our carrier partners.

For ‘ad-hoc’ shippers, please see as follows…

DHL Express: As long as your shipment is registered (from Concept) before 13:00, it should be collected by DHL Express the same afternoon.*

DHL Parcel (UKMail): As long as your shipment is registered (from Concept) before 13:00, it should be collected by DHL Parcel the same afternoon.*

DPD: As long as your shipment is registered (from Concept) before 11:45, it should be collected by DPD the same afternoon.*

Evri (C2C): As long as your shipment is registered (from Concept) before 23:59 it should be collected by Evri, the next day (Mon to Sat).

* Each carrier will only send 1 courier once, per day. i.e. If you register a shipment at 10:00 and DHL Parcel send a courier to collect at 11:00, there will be no further collection attempts until the next working day.

RDS are invoiced weekly by our carrier partners & suppliers, to enable us to vet those invoices the following week, against the information declared at the time of booking (by our customers), to ensure that what we have been invoiced, matches what we are expecting to be invoiced from our suppliers.

We then invoice our customers the following week, meaning two weeks have now passed since the original booking was placed, enabling us to pass any additional charges on the same invoice, that the original job should appear.

This also allows for our 14 day invoice query terms, to fall in line with our suppliers invoice query terms.

To summarise, bookings from our customers made in week one, we get invoiced in week two, at which point we run our invoice checks. When then invoice our customers in week three, with 14-day payment terms.

As 14 days have already passed from the booking date, our customers effectively enjoy 28-day payment terms.

Once the chosen carrier has received your item, whether that be the collection drivers scan, depot receipt scan, central hub, delivery depot or delivery drivers scan, the status on RDS will remain as ‘Registered’.

Only once the carrier has receipt of your item(s) by way of a scan, only then will they accept that they have received your item(s).

Without a scan, they will not accept having received the item.

We therefore STRONGLY suggest (where possible) every item that leaves your premises, you witness a driver collection scan.

Where our customers request for additional carrier, customs, taxes and/or duties to be paid (immediately) by RDS (DDP) in order for the goods to be cleared and delivered much quicker, an arrangement fee of £5 or 5% of the total value of the invoice (whichever is the greater), will be added to the invoice.

Once received, additional carrier, customs, taxes & duties invoices are passed back to our customers at cost, with 7 day payment terms.

There are some restrictions with our carrier partners, as to what you can and cannot drop off to a ParcelShop.

Firstly, make sure that you measure and weigh your parcel accurately to ensure that your parcel isn’t rejected by the shop because it doesn’t meet the below criteria.

You can send up to 25kg and no one side of your parcel must exceed 120cm and the other two sides cannot exceed 50cm.

- Your parcel must be no bigger than 60cm x 60cm x 60cm

- No one side of your parcel must exceed 120cm

- It cannot weight more than 20kg

- You cannot drop off any prohibited items at a ParcelShop

These may also be referred to as:

• Harmonised System Codes (HS Codes) = first 6 digits of a Commodity Code, used worldwide.

• Tariff Headings / Codes

• CN or Classification Codes

The UK Commodity Code is a 10-digit number used to classify goods at the point of entry into the UK or worldwide, whereas the code used for exports is 8 digits long.

It is used to determine what duty is payable, whether to apply Rules of Origin and what regulatory requirements exist. Identifying the correct commodity code is crucial.

RDS carrier partners charge and therefore RDS pass, a City Congestion Charge for all consignments to postcodes commencing:

E1 6, E1 7, E1 8, EC1, EC2, EC3, EC4, N1, NW1 , SE1, SE11, SW1, W1, W2, WC1, WC2

Should the outbound delivery be unsuccessful for whatever reason, all carriers charge for a ‘return to sender / consignor’ and is often, more expensive than the outbound shipping.

Why? Because the cost of a return (reverse logistics), is significantly greater than that of the outbound delivery, as 1. the item travels on its own without the consolidation of the outbound parcels and 2. every return is unique, as in the networks are not set up specifically to deliver each return.

Unless shipments are ‘Void’ (cancelled) on the portal, they will be charged for by RDS.

Why? Because if we didn’t charge for shipments with a ‘Registered’ status, and those shipments were then despatched after the week period RDS have just invoiced for, they would be missed.

Also, some carriers charge for shipments registered and not cancelled, so its important to cancel those shipments you no longer wish to send.

Please note, there is a £0.20p +vat ‘Cancelled Shipment’ fee to cover shipping software costs.

Customs agents, suppliers and advisers may be able to help, but the legal liability for applying the correct commodity code sits with the entity whose name is on the import documentation (“the importer of record”.)

It is important that you are satisfied the commodity code is correct, especially for large value items or items you import regularly because this dictates any tax liability and import/export controls.

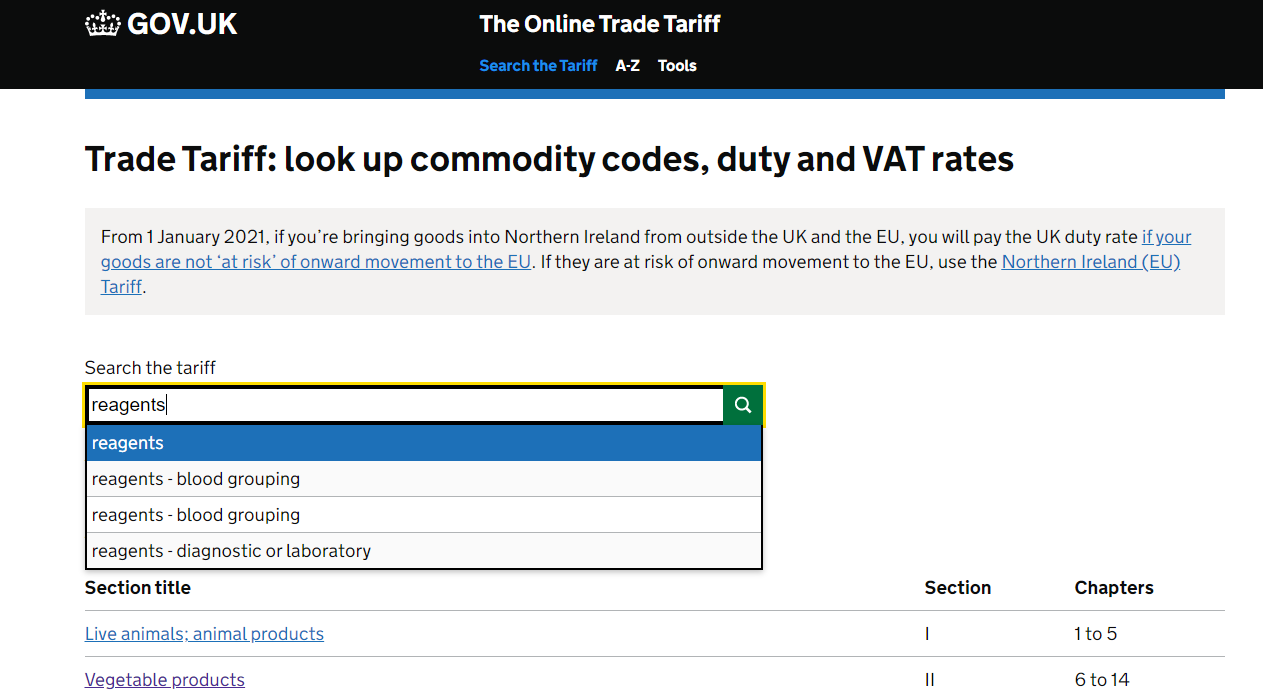

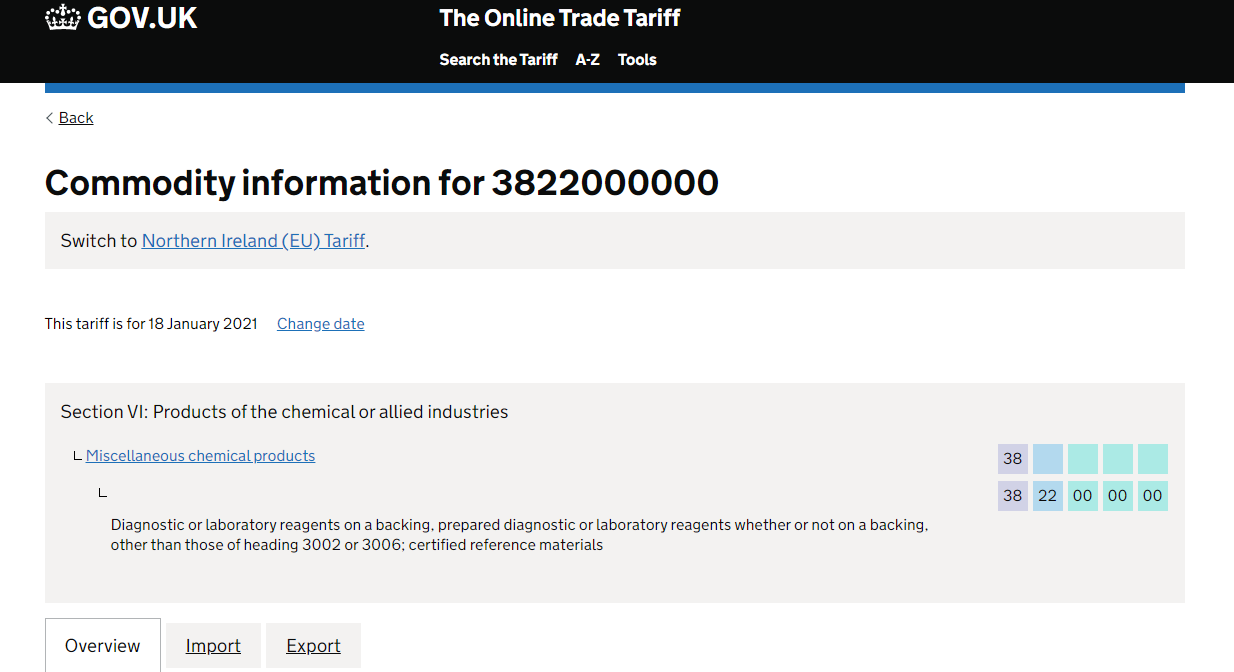

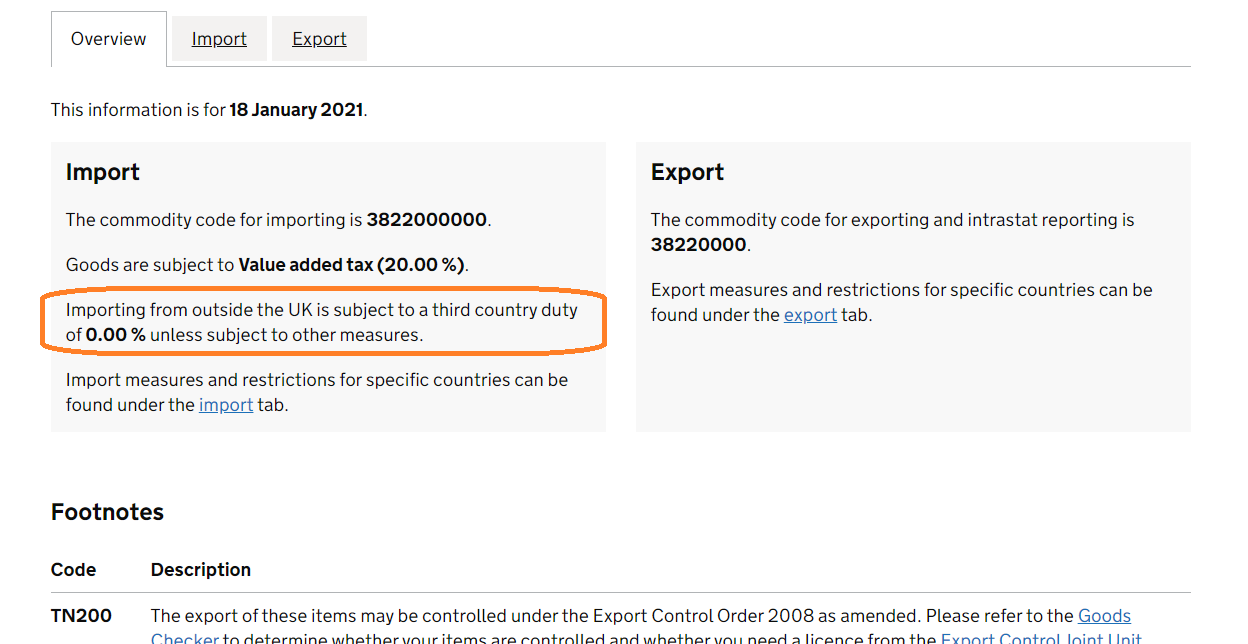

The screenshots below explain how a Commodity Code can be checked in the UK Tariff.

Finding commodity codes for imports into or exports out of the UK is worth referring to if you are having difficulties identifying a Commodity Code. It includes a link to guidance on a variety of goods that are hard to classify, including:

- Computers and software

- Audio and video equipment

- Plastics

- Pharmaceutical products

- Organic chemicals

How to find or check a Commodity Code in the UK Tariff

- Contact the supplier of the goods and ask them for the Commodity Code. If the HS Code is provided this will consist of 6 digits, which will be the start of the UK Commodity Code.

- You should always check the Commodity Code using the Check UK Trade Tariffs service, especially for purchases of a significant value.

- Click on the UK tariff and click on “Start now”. Type either a description of the goods or the commodity code (or a part of the commodity code) into the search bar, to see the various options available. You also have the option to scroll down to look at the sections or use the A-Z tab.

Select the relevant option – you may need to click on several layers until you find the relevant sub-codes.

Select the relevant option – you may need to click on several layers until you find the relevant sub-codes.

Scroll down to see the applicable rate of duty on import into the UK:

- The EU Tariff (known on Gov.UK as the Northern Ireland (EU) Tariff) currently provides more information than the UK Tariff – especially about whether you may need an import/export licence. It is prudent to also check the commodity code against the EU Tariff – as that is what any EU customer will need to reference. You can do this by clicking on the ‘Switch to Northern Ireland (EU) Tariff’ in the top left corner of the UK Tariff.

- Click on the import tab, find the country the goods originate from or are going to, and see if any special measures/restrictions are in place.

Volumetric weight, is a pricing technique used within commercial freight transport, which uses an estimated weight that is calculated from the length, width and height of a package(s).

The shipping fee is then based upon the dimensional weight or the actual weight, whichever is greater.

Reason being, if only charged on weight, lightweight, low density packages become unprofitable for freight carriers due to the amount of space they take up in the lorry/aircraft/ship in proportion to their actual weight.

Volumetric weight is either calculated by multiplying the length, width and height of a parcel (in cm) and dividing that figure by 4000 for road services & 5000 for express air & UK domestic services.

It may also be calculated by its girth, with the following calculation: 1 x length + 2 x width + 2 x height.

Providing the correct dimensions are declared at the point of booking, the RDS portal will calculate and quote, based on the greater of the two measurements.

Items that cannot be delivered by the carrier, are mostly returned to sender at an additional RTC (returned to consignor) cost. The reason being, is that the cost of the reverse logistics to get the item returned, is actually greater than the outbound cost for delivery.

Its the responsibility of the sender (consignor) to ensure all goods that are shipped are correctly addressed, with the receivers mobile and/or email address provided at the point of booking (to know when to expect the delivery and request necessary alternative delivery dates if not practical) and to ensure items are robustly packaged to withstand transit through a parcels network.

For more information on how to pack your parcels, please click here.

When printing from a desktop printer and using A4 sticky address labels, only use ‘borderless’ label pages to ensure the address prints on the ‘tear away’ label only.

To avoid doubt, search: ‘White Paper Square Cut Labels – 4 Per A4 Sheet – 105 x 148.5mm’ for the right type.

Unless liability is offered at the point of booking, then no liability is provided when it comes to Parcel Shop drop off services.

Why? Because Parcel Shop drop off parcels are typically sent by the public who mostly have very little, if any experience, in how to pack and present parcels for courier networks.

Its for this reason that the carriers do not offer liability as standard.

Where a query has been raised with RDS for a job relating to one of our carrier partners, RDS will invoice the job as per usual, having likely already paid the carrier for the job in question.

As part of the RDS service, we’ll pursue a claim with the carrier where there is a case to be answered and if successful, we’ll receive a credit from the carrier which we’ll pass on to our customer.

In the meantime, the invoice amount and invoice due date will need to be honoured.

UPS Worldwide Standard: Delivery in 2-5 business days via road to Europe, by the end of the day

UPS Worldwide Expedited: Delivery in 2-5 business days (non-urgent) by the end of the day to more than 70 countries and territories.

UPS Worldwide Express Saver: Delivery in 1-3 business days by the end of the day to more than 215 countries and territories.

UPS Worldwide Express: Delivery in 1-3 business days by 10:30 a.m. or noon., to more than 65 countries and territories.

The Emergency Situation Surcharge (ESS) is a surcharge imposed by DHL Express, to reflect changes in market dynamics, air capacity availability and operational restrictions imposed related to COVID-19 measures from local governments.

As these surcharges are variable and therefore could change over time, RDS will pass this surcharge at cost on our invoice, in addition to the quoted rate on the portal, (as quoted on our rate card, the notification banner at the top of the booking portal and at the footer of our website (see below)) until further notice.

Whilst our carrier partners mostly deliver a 95<98% first time success rate, there are the occasional parcels (2<5 in 100) that can sometimes take a little longer, due to all of variables involved in getting your parcel to where it needs to get to.

Firstly, your collection driver will have many collection stops, following many delivery stops that morning, before getting back to his / her depot on time, to meet the last trailer.

This trailer will then need to get to the central hub in time for your parcel to be unloaded and then loaded to the relevant conveyor, passing through many ‘hands’ for your parcels onward journey.

This then needs to be loaded to the relevant trailer (assuming it has sorted & therefore loaded to the right trailer, otherwise this was cause a 24hr delay) and then line hauled to the delivery depot, in time for the delivery sort.

Once unloaded at the local delivery depot, your parcel will need to be sorted into the delivery drivers routes, often with 100+ other parcels / stops, for the courier to deliver, assuming no hold ups or issues on route.

Then, with all things being well, i.e. no punctures, vehicle breakdowns, motorway closures / severe traffic, adverse weather, security alerts, staff shortages / sickness etc, etc, your parcel ‘should’ arrive the next day, and even better, within the time slot estimated by the carrier, but as you’ll hopefully appreciate, there can be no guarantees.

DHL Parcel surcharge any item that exceeds 1.2m in length as a ‘Long Length’ surcharge. Items that exceed 2m to a maximum of 3m, will be surcharged as a ‘XL Long Length’.

They also use this surcharge description when surcharging for ‘Out of Gauge’ / ‘Over Maximum’ which can often confuse customers. Please refer to your tariff, or speak with your RDS contact for more information.

Over Maximum Surcharge

• Items that have two sides of more than 80cm in size or a single side of 120cm or more

• Requires more than 1 person to lift due to weight or size (greater than 30kg)

• Is an awkward shape, for example: – Chair, Bike, Coat stand, Car body panels, Trees, Canoe

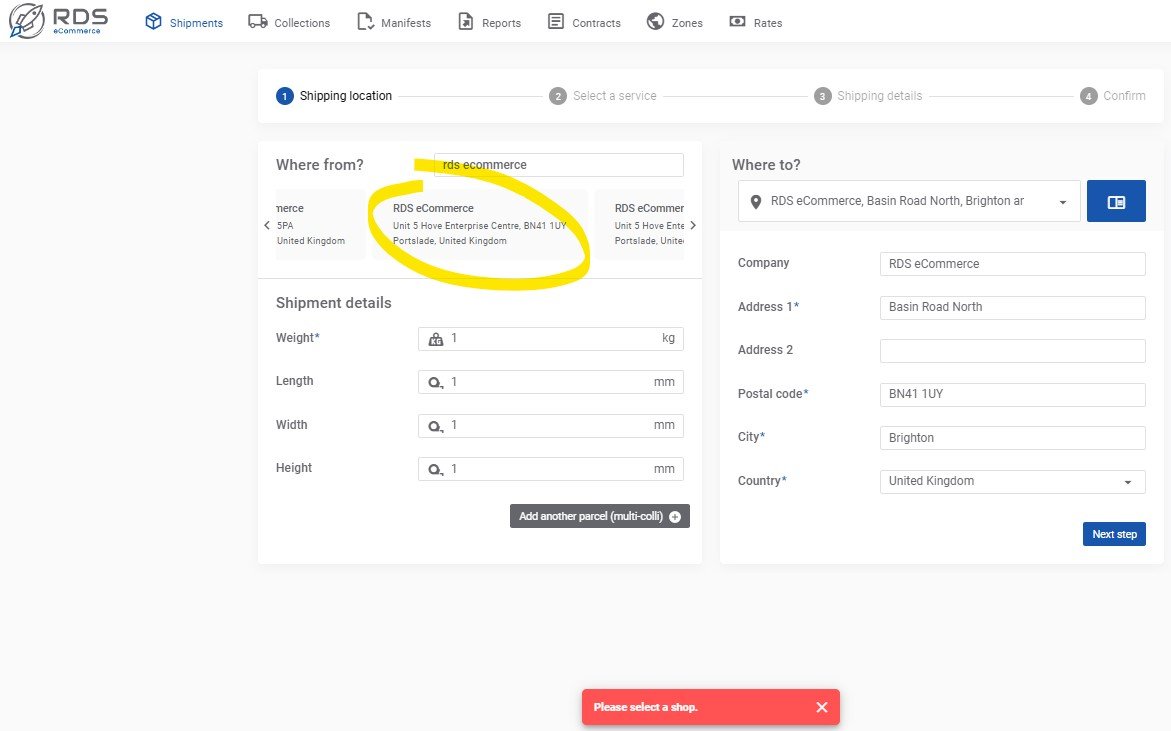

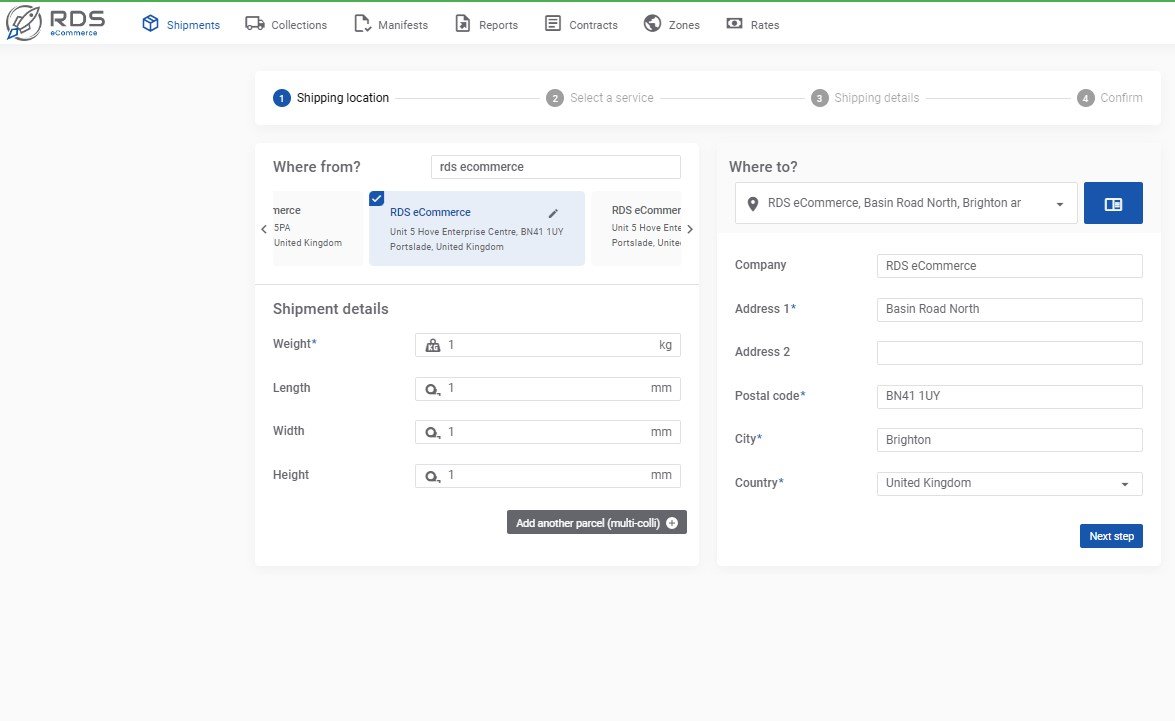

When booking on the RDS portal, you need to select ‘Where from?’ first, before proceeding to the delivery address details.

Once selected once (see below), it’ll remember the collection address for the next time:

Where a signature has been offered at the point of booking, but not selected, that carrier reverses the right to ‘leave safe’ without the requirement of a signature.

Where a signature has not been offered, that carrier will only provide a ‘signed for’ service, unless otherwise requested in transit, by the recipient.

If the courier is unable to deliver the goods, due to no one being at the delivery address, no neighbour to leave with, or no safe place, that courier may redirect your parcel to the closest ParcelShop location, to ensure both a quicker and (mostly) more convenient delivery.

LEAVE SAFE: Leave safe deliveries should be out of the sight of the general public (those people that would not have a reason to be passing such as; residents or workers of the building, that the goods have been delivered to), i.e. which is not an exposed doorstep from public view.

Where non signed for services are requested, unfortunately the carrier provides no liability for loss.

Should you be faced with the unfortunate but rare situation, where a carrier has either lost or damaged your goods in transit and there is liability cover (check https://rds-globalsolutions.com/terms-conditions/ for cover), the carrier shall require the following information, that we (RDS) will collate, submit and manage the claim on your behalf.

- Description of the parcel. Any unique markings, stickers, tape etc..

- Description of the goods inside.

- A copy of the sales invoice (you to your customer).

- A copy of the cost invoice (your supplier to you).

- If damaged, photo(s) evidence of the damage of the goods.

- If damaged, photo(s) of the packaging as delivered.